Explore the latest IRS tax code updates and discover strategies to reduce excessive taxation. Get expert insights on optimizing your financial future.

OBBBA Tax Update: What the New Giving Rules Mean for Your Wallet

The One Big Beautiful Bill Act (OBBBA) brings some of the biggest changes to charitable giving in years. While the rules for tax professionals are

Maximizing Retirement Savings: The Strategic Power of Health Savings Accounts (HSAs)

As retirement planning grows increasingly complex, sophisticated investors and their financial advisors are seeking advanced strategies to maximize capital preservation and minimize tax liabilities. One

Trump Accounts: Outlines by IRS

The Internal Revenue Service (IRS) on Tuesday released initial details regarding the new Trump Accounts, which are individual retirement accounts (IRAs) established for eligible children

2026 Retirement Plan Limits Adjusted for Inflation

The Internal Revenue Service (IRS) on Thursday announced the 2026 benefit and contribution limits for qualified retirement plans, including contribution maximums for Section 401(k) plans

Fact Check: Is the One Big Beautiful Bill Act (OBBBA) the Biggest Tax Cut Ever?

OBBBA signed into law on July 4, 2025, introduces major tax changes for individuals and businesses, including new deductions and permanent extensions of prior tax

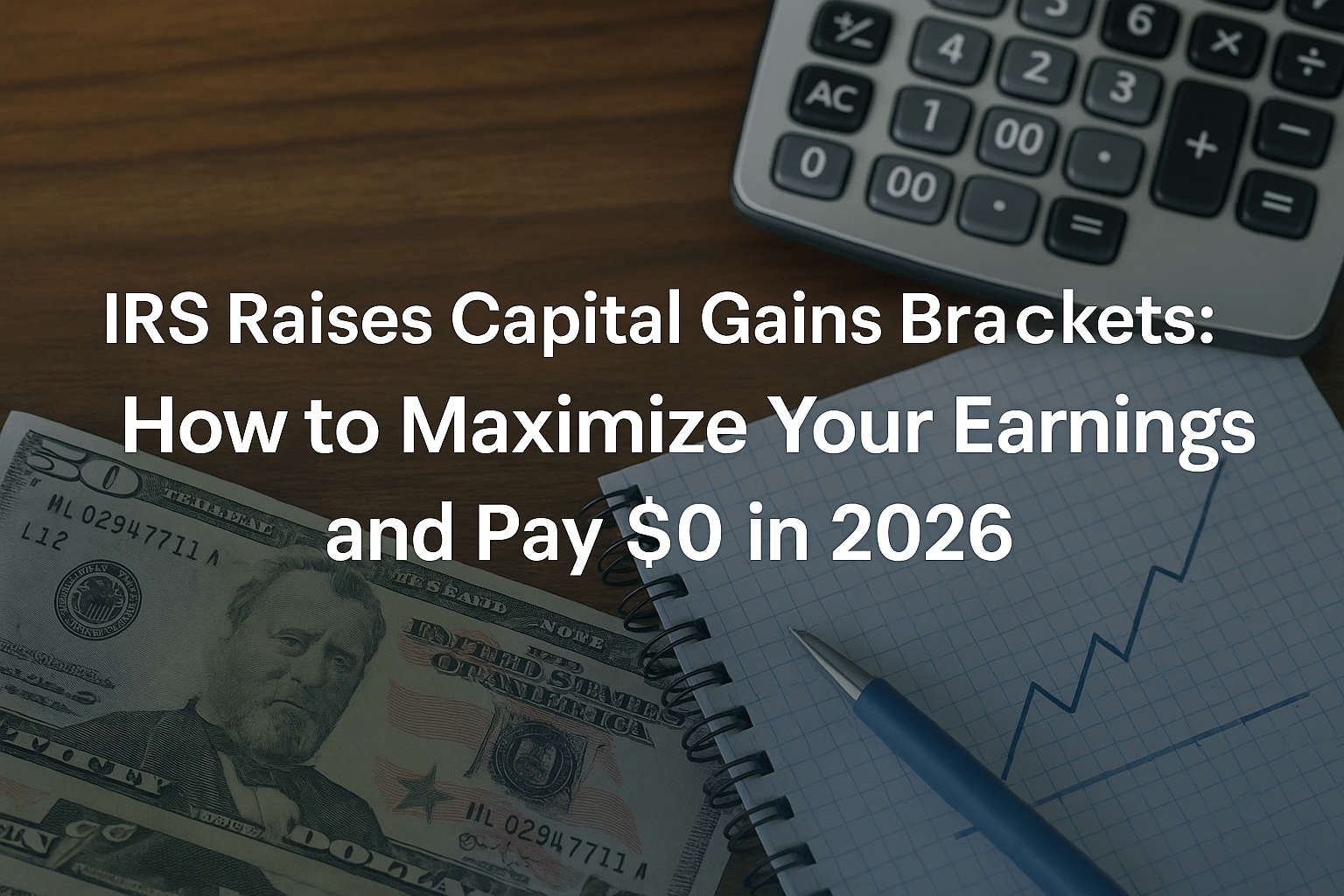

IRS Raises Capital Gains Brackets: How to Maximize Your Earnings and Pay $0 in 2026

The Internal Revenue Service (IRS) has announced updated tax brackets for the 2026 tax year, including notable adjustments to long-term capital gains rates. These changes

Trump’s Temporary SALT Deduction Increase for 2025

President Donald Trump’s so-called “big beautiful bill” will temporarily raise the cap on the federal deduction for state and local taxes (SALT) from $10,000 to

When Does Your Dependent Child Have to File a Tax Return?

Understanding whether your child needs to file a tax return depends on the type and amount of income they earn, and whether they qualify as

Key Tax Provisions — Final Legislation with Comparison Across 2025 Reconciliation Bills

Individual Key Tax Provisions Tax Provision Current Law House Bill Senate Bill (Approved by House) Individual Income Tax Rates TCJA rates expire after 2025; seven

Intentionally Defective Grantor Trust (IDGT): Definition, Benefits & Examples

A well-crafted estate plan ensures your wealth reaches your intended beneficiaries—not the IRS. If you’re looking to transfer assets efficiently while retaining financial control, an

Taxation of S Corporation Distributions Involving Accumulated Earnings and Profits (E&P)

C corporations are generally subject to double taxation: once at the corporate level when income is earned, and again at the shareholder level when that

One Big Beautiful Bill Act: Full Breakdown of the 2025 House Tax Proposal

Introduction On May 22, 2025, the U.S. House of Representatives passed the “One Big Beautiful Bill Act” (the House Bill), which extends or makes permanent