OBBBA signed into law on July 4, 2025, introduces major tax changes for individuals and businesses, including new deductions and permanent extensions of prior tax cuts.

This law served to extend the expiring provisions of the Tax Cuts and Jobs Act (TCJA) while also implementing several new tax cut proposals from the president.

Based on conventional measurements, the OBBBA is projected to decrease federal tax revenue by $5 trillion between 2025 and 2034. It is also important to note that the OBBBA contained spending reductions, which helped to counteract a portion of its impact on the deficit.

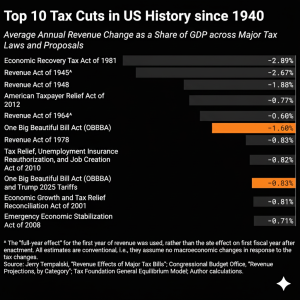

Several political figures and the White House have promoted the OBBBA as the “largest tax cut in American history.” However, while the law is substantial, this claim is not accurate; it is the sixth-largest tax cut in modern history.

To properly understand and contextualize the scale of various tax bills over time, it is necessary to compare their reduction in tax revenue relative to the size of the U.S. economy at the time they were passed. This is done by measuring the revenue change as a share of GDP. (The revenue impact data for past legislation is sourced from the U.S. Treasury and the Congressional Budget Office.)

When analyzing its tax provisions in isolation (without the spending changes), the OBBBA reduces federal revenue by an average of 1.4 percent of GDP over its 10-year budget window. This is considerably larger than the TCJA, which was the tenth-largest tax cut when it was passed (and is now the 11th, displaced by OBBBA), as it reduced revenue by an average of 0.69 percent of GDP.

| Tax Bill | Revenue Change as a Share of GDP, Average over Budget Window |

| Economic Recovery Tax Act of 1981 | -2.89% |

| Revenue Act of 1945^ | -2.67% |

| Revenue Act of 1948 | -1.87% |

| American Taxpayer Relief Act of 2012 | -1.78% |

| Revenue Act of 1964^ | -1.60% |

| One Big Beautiful Bill Act (OBBBA) | -1.40% |

| Revenue Act of 1978 | -0.83% |

| Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 | -0.77% |

| One Big Beautiful Bill Act (OBBBA) and Trump 2025 Tariffs | -0.73% |

| Economic Growth and Tax Relief Reconciliation Act of 2001 | -0.71% |

| Emergency Economic Stabilization Act of 2008 | -0.70% |

The five tax cuts since 1940 that were larger than the OBBBA are: the Economic Recovery Tax Act of 1981; the Revenue Acts of 1945, 1948, and 1964; and the American Taxpayer Relief Act of 2012. As a group, these laws reduced revenue by amounts ranging from 1.6 percent to 2.9 percent of GDP on average.

Historically, the Revenue Acts of 1945 and 1948 were significant postwar measures designed to ease the heavy tax burdens imposed on Americans during wartime. The 1964 Revenue Act, first proposed by President Kennedy and enacted by President Johnson, aimed to “reduce the drag on private purchasing power, profits, and employment” by substantially lowering both corporate and individual income taxes. Under President Reagan, the Economic Recovery Tax Act of 1981 simplified business taxes and dramatically cut individual income tax rates. More recently, the American Taxpayer Relief Act of 2012 made many of the Bush-era tax cuts permanent, in addition to other tax modifications.

Concurrently with signing the OBBBA into law, President Trump has utilized the International Emergency Economic Powers Act (IEEPA) and national security Section 232 to impose new tariffs, which function as a tax increase by raising revenue. The Trump administration has, at times, suggested these tariffs would help finance the tax cuts. As of November 1, these new tariffs are estimated to increase tax revenue by $2.4 trillion from 2025 to 2034 (conventionally measured). Standing alone, this represents the most significant tax increase since 1993.

These tariffs will counteract a substantial portion of the OBBBA’s tax reductions. This results in a net revenue reduction of $2.6 trillion over the decade, or 0.73 percent of GDP. When this combined effect is measured, the legislation ranks as the eighth-largest tax cut since 1940, placing it much closer in scale to the original 2017 TCJA. The OBBBA also included approximately $1.1 trillion in spending cuts, which further offset its deficit impact.

In conclusion, although the OBBBA is a significant piece of tax legislation, the reduction in revenue ranks it as the sixth-largest tax cut in U.S. history, not the largest. Furthermore, when the president’s tariff-based tax increases are factored into the equation, the law’s standing drops to the eighth-largest tax cut in modern history.